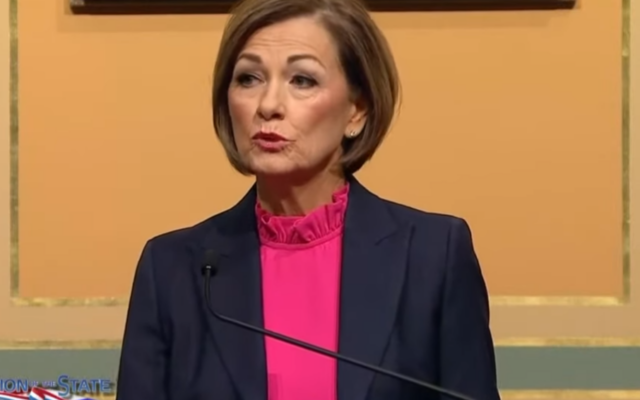

Reynolds raises concerns about Senate GOP’s sales tax maneuver

JOHNSTON — Governor Kim Reynolds says she and her fellow Republicans in the House and Senate are about two-thirds of the way toward reaching a final agreement on a tax plan.

The governor is raising concerns, though, about the Senate GOP’s idea to convert more than 800 local option sales taxes into one statewide tax. It’s a legal maneuver so lawmakers could use other state tax money to fill the empty Natural Resources and Outdoor Recreation Fund, but Reynolds said she’s concerned because the move impose a one percent sales tax in three counties and four dozen cities that aren’t collecting it today.

“With inflation at a 40 year high we have to be really careful about raising taxes right now. I’m interested in lowering taxes,” Reynolds said this morning. “Even though, potentially, it would be an overall tax reduction, we just need to take all of that into consideration as we sit down and start to work through that compromise.”

Reynolds made her comments during taping of “Iowa Press” which aired over the weekend on Iowa PBS.

The other sticking point in the GOP tax negotiations is whether to cut the corporate income tax. Reynolds has proposed a significant cut. Senate Republicans propose a cut, along with reductions in some tax credits corporations typically claim. Reynolds said she’s not ready to agree to reducing the research activities tax credit, for example.

“We have a pretty rich research and development tax credit and so maybe there are some adjustments we can make, but I don’t know that right now,” Reynolds said. “What we want to do is take an overall look at the tax credits that we have on the books and see where we go from here.”

Reynolds has indicated that study can start this summer, after the legislature adjourns.

House Republicans have passed a bill that solely focuses on reducing personal income taxes and would not cut the corporate income tax rate.